Feb. 4, New Delhi, India: According to a research by Dolat Capital, Oil Marketing Companies (OMCs) are anticipated to suffer short-term difficulties because of a number of issues, such as poor Singapore Benchmark Gross Refining Margins (GRM), dropping integrated margins on motor fuel, and no budgetary help for LPG under-recovery.

“In the near term, OMCs will remain under pressure mainly due to (1) the absence of budget support for LPG under-recovery; (2) weak Singapore Benchmark GRM at USD 2.4/bbl Q4TD vs. spot of USD 9.6/bbl; and (3) integrated margins on auto fuel at Rs8/lt vs. long term avg. of Rs11.5/lt.” According to the study

However, the research also notes that while the lack of budgetary assistance for the LPG under-recovery is still a worry, the OMCs may benefit financially from the government’s decision to not raise excise tax in FY26 as well as reduced crude prices.

The estimated LPG under-recovery for FY25 will be compensated, according to analysts, by an extra Rs 2.5 per liter Gross Marketing Margins (GMM) on vehicle fuels.

OMCs may continue to generate higher-than-average Gross Marketing Margins (GMM) on motor gasoline given the government’s decision to maintain excise tax at its current level and the decline in crude oil prices.

Compared to restated FY25 statistics, the newly released FY26 budget anticipates a small 3.5% rise in overall excise duty collection.

On a spot basis, OMCs are now earning Rs 7.5 per liter in GMM. The adjusted GMM for vehicle fuels is Rs 5 per litre, which is still higher than long-term averages even after taking into consideration the effect of LPG under-recovery (Rs 2.5 per liter).

Interestingly, OMCs made Rs 8 per litre GMM on vehicle fuels in the first nine months of FY25, which is far more than the long-term average of about Rs 3.5 per liter.

OMCs nevertheless confront challenges in spite of these possible safeguards. In Q4 thus far, Singapore Benchmark GRM has dropped to USD 2.4 per barrel from a spot pricing of USD 9.6 per barrel.

Additionally, vehicle fuel integrated margins have decreased to Rs 8 per litre, which is less than the long-term average of Rs 11.5 per litre.

The FY26 budget does not specifically address LPG under-recovery for OMCs, but it does provide Rs 127 billion in overall support for a number of initiatives and programs.

In the calendar year 2024 (CY24), India’s consumption of petroleum products increased 4.3% year over year (YoY), mostly due to volume increases.

-

High-Risk Tourist Spots in Maharashtra to Remain Closed During Monsoon Day After Pune Bridge Collapse Tragedy

-

2 Rooms, 3 Bodies: Three Of Family Found Hanging From Fan In Kolkata Home

-

Inside Midsomer Murders star John Nettles' life after leaving hit ITV drama

-

Chappell Roan reveals when online hate hits too hard: "It makes me cry"

-

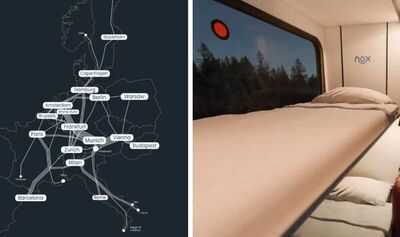

Incredible new train network could connect '100 European cities' - mapped