If ITR Filing is done on time, then you will not face any problems in the future. Taxpayers have now gradually started filing their income tax. In this digital era, you can file your ITR sitting at home with the help of a mobile or laptop without any assistance.

First of all, let us know how to file ITR online (ITR Filing Online).

Step-by-Step Process

Step 1- First of all you have to go to the official website of Income Tax.

Step 2- Now you have to choose the option of e-file from the option given in the blue bar.

Step 3- After clicking, you must first choose the option Income Tax Returns.

Step 4- Now here you will be asked to choose the Assessment Year and Mode of Filing.

Step 5- In the Assessment year you have to enter 2024-25. At the same time, choose the option of Online in Mode of Filing.

Step 6- Now choose any one of the three different options for Status Applicable - Individual, HUF, and Others.

Step 7- After this, select your ITR type. Here you will be given the option of 7 different ITR forms.

Step 8- Now you have to choose why you want to file ITR.

Step 9- After this, you will be asked for information like personal information, total income, total deduction, and tax paid. Fill it carefully.

Step 10- Finally you have to e-verify, this step is very important. You can e-verify ITR with the help of Aadhaar OTP, EVC net banking, etc.

What documents are required?

Form 26AS or Form 16A will be required.

If you pay rent, then a rent agreement will be required for this, so that HRA can be claimed.

You will also have to submit proof of tax deduction.

If you have income from abroad, then you will have to provide a foreign bank account statement for this.

Along with this, if you have ever filed an ITR before, then its proof will be required.

Along with this, you will have to provide a salary slip for income proof.

In this way, you can file ITR in easy steps.

Disclaimer: This content has been sourced and edited from Dainik Jagran. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Sunjay Kapur Funeral: 14-Year-Old Son Kiaan Breaks Down, Karisma Kapoor Consoles Him; Heartbreaking Visuals Surface

-

'Death zone' temperatures set to bake UK and it could get hotter

-

'Death zone' temperatures set to bake UK and it could get hotter

-

'Death zone' temperatures set to bake UK and it could get hotter

-

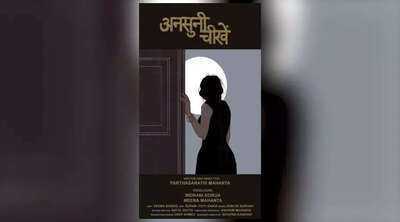

Assamese Short Film 'Ansuni Chinkhe' Shines on Global Stage