The Tel Aviv Stock Exchange (TASE) surged to a 52-week high on Thursday, even as tensions between Iran and Israel intensified. Despite reports of a direct missile strike damaging the stock exchange building, investors continued to bet on local equities, pushing major indices into positive territory.

According to Al Jazeera, the latest Iranian offensive involved the launch of 25 missiles, targeting key locations including the Israeli stock exchange. Nonetheless, the TASE All Share Index climbed 0.5 per cent, reaching a 52-week peak of 2,574.89. The TA-35 and TA-125 indices followed suit, hitting new yearly highs of 2,810.85 and 2,850.08, respectively.

The flagship TA-125 index has shown a strong upward trend since hostilities began on June 13, posting a 5 per cent gain during this period. In fact, the index has been on a consistent rise, up 4.53 per cent in April and 6.55 per cent in May, suggesting strong investor confidence in the underlying economic fundamentals despite external threats.

Iranian Strikes Trigger Alarm

AFP confirmed that a hospital in Beersheba and nearby towns close to Tel Aviv were among the targets of Thursday’s missile barrage. Sirens rang out across Israel in the early hours, with multiple explosions reported in Tel Aviv and Jerusalem. A military source stated that "dozens of ballistic missiles" had been launched by Iran in the attack.

In response, Prime Minister Benjamin Netanyahu warned that Iran would "pay a heavy price," while Defence Minister Israel Katz instructed the military to "intensify" retaliatory actions.

Global Markets Shaken

The ongoing conflict has cast a shadow over global equity markets. European shares recorded their third consecutive day of losses, dragging the STOXX 600 index down 2.5 per cent for the week—its steepest weekly drop since April’s tariff-driven slump.

In the US, S&P 500 futures dipped 0.6 per cent. However, American financial markets, including Wall Street, remained shut on Thursday due to a national holiday. The uncertainty also weighed on Asian markets; Taiwan's benchmark index declined by 1.5 per cent, while Hong Kong’s Hang Seng fell 2 per cent.

Indian markets, however, managed to stay largely stable. The benchmark indices edged only 0.05 per cent lower in the afternoon session, showcasing the region’s comparative economic insulation from the Middle Eastern conflict.

-

'Death zone' temperatures set to bake UK and it could get hotter

-

'Death zone' temperatures set to bake UK and it could get hotter

-

'Death zone' temperatures set to bake UK and it could get hotter

-

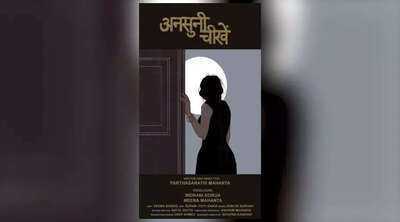

Assamese Short Film 'Ansuni Chinkhe' Shines on Global Stage

-

Comparative Review: Mahindra BE 6 vs Maruti Suzuki Fronx SUVs