How Otipy Ran Out of Stock

How Otipy Ran Out of Stock

Once a disruptor in the realm of the agritech sector with its fresh-from-farm model, . Well, the startup that raised $70 Mn from VCs like WestBridge Capital, Omidyar in its five-year lifespan couldn’t help but fall to the ground as quick commerce players uprooted it with speed, scale and instant gratification.

So, how did one of the pioneers of India’s farm-to-fork startup ecosystem crumble?

The Flawed Fundamentals: Even with the massive funding, the capital-intensive nature of last-mile delivery, razor-thin margins on fresh produce, and the unmanageable nature of demand forecasting in perishable categories brought down Otipy’s house of cards.

The Quick Commerce Blow: Otipy, which connected end consumers to farmers through a community of resellers, gained initial traction on the back of customers willing to wait for quality produce. However, the startup’s unit economics, user retention and sales went for a toss as Otipy’s limited product range and longer delivery timelines were bound to lose against 10-minute apps.

Even as the company’s leadership explored pivoting to faster deliveries, what proved to be the death knell for Otipy was the lack of capital, logistics complexities and higher wastage risks that come with speed.

Vendors Grilled In The Grind: Left in the lurch are the company’s suppliers, who are yet to receive their payments since January. Furthermore, Otipy’s management has halted all communication with their employees, offering them no clarity on when their dues will be settled.

The shocking demise of Otipy, following rival Deep Rooted quietly calling it quits, has raised questions about the sustainability of the farm-to-table model. Besides, many that are operational, and DeHaat, are in deep waters due to operational issues, rising debts and layoffs. While that is a topic for yet another day, here’s how

From The Editor’s Desk: The IPO-bound hyperlocal services startup reported a net profit of INR 239.7 Cr in FY25 against a loss of INR 92.7 Cr in the previous fiscal. Operating revenue jumped 38.2% YoY to INR 1,144.4 Cr in the fiscal under review.

: The telecom startup has raised the funds in a round co-led by Accel and Prosus at a valuation of $200 Mn. The startup provides affordable and unlimited internet services to middle and lower-middle-income households under the PM-WANI Scheme.

: The IPO-bound jewellery brand is looking to raise INR 300 Cr to INR 350 Cr at a valuation of $1.15 Bn. Meanwhile, existing backers 360 One and Centrum Wealth are also looking to sell their stakes. BlueStone has filed its DRHP to raise INR 1,000 Cr.

The VC firm has raised over INR 200 Cr for its maiden fund, which aims to back 20 startups operating in the edtech, fintech, and consumer services spaces. The fund will dish out cheques in the range of $1 Mn to $1.5 Mn.

: Former chief business officer of Unacademy Abhinav Agarwal is launching a new startup in the eyewear space. The new venture has already raised $2.2 Mn seed funding in a round led by India Quotient.

: The electric bike maker has marked the final close of its $11 Mn Series A funding round, which saw participation from Helios Holdings, Sharda family office, and others. The company designs and manufactures EV motorcycles and EV components.

: The B2B ecommerce startup’s public issue was subscribed 24% on the first day, led by strong demand from retail investors. Meanwhile, NIIs bid for 6.9 Lakh shares as against the 35.68 Lakh shares reserved for them, resulting in 19% subscription.

Drivers at the ride-hailing unicorn can avail the benefits of a zero-commission model after subscribing to its 30-day pass for INR 67 a day. The startup will join the ranks of Rapido and Namma Yatri that introduced the zero commission model.

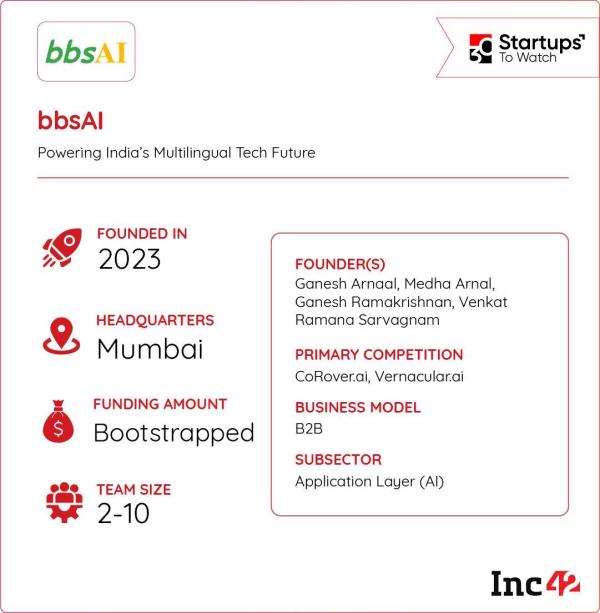

Inc42 Startup Spotlight Can bbsAI Power India’s Multilingual Tech FutureWhile there is a surplus of AI offerings and datasets in English, there seems to be an acute dearth of such critical tools in Indic languages. Realising that it posed a challenge for building localised AI solutions, Ganesh Arnaal and Ganesh Ramakrishnan founded bbsAI in 2023.

India’s Indic AI Future: The Mumbai-based startup is focussed on building India-focussed AI infrastructure. Its Udaan Translation Engine offers translation and document processing in multiple Indic languages, while ABAACU and bbsHindiOffice support everything from government communication to enterprise workflows.

The SLM Approach: Instead of deploying a large language model, bbsAI’s unique approach is built on leveraging small language models that focus on explainability and reliability by design.

While there are existing players like Synthesia.io, Lilt, and DeepL making waves in the space, bbsAI has much room to grow in India’s GenAI market, which is expected to become a $17 Bn opportunity by 2027.

The post appeared first on .

-

Voting for Assembly bypolls begins in four states amid tight security

-

'I got the surprise of my life after throwing an empty bottle into the sea 30 years ago'

-

Initial Share Sale Of Arisinfra Solutions Receives A 24% Subscription On First Day Of Bidding; ₹500 Crore IPO To Conclude On June 20

-

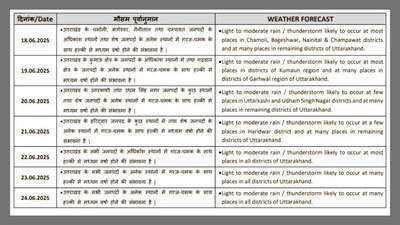

Uttarakhand Weather Forecast: Heavy Rain and Thunderstorms Expected Soon

-

Jasmin Bhasin Opens Up About Her Challenging Experience on 'The Traitors'