Pakistan signed a five-year long-term syndicated financing facility for USD 1 billion, indicating strong support from leading financiers amid the country's ongoing economic crisis.

The Dubai Islamic Bank acted as the Sole Islamic Global Coordinator while Standard Chartered Bank is the Mandated Lead Arranger and Book-runners, a finance ministry statement said on Wednesday.

Other financiers include Abu Dhabi Islamic Bank as the Mandated Lead Arranger and Sharjah Islamic Bank, Ajman Bank and HBL as Arrangers, it said.

“The Ministry of Finance has signed a syndicated term finance facility of USD 1,000 million partially guaranteed by a policy-based guarantee of the ADB (Asian Development Bank) programme ‘Improved Resource Mobilisation and Utilisation Reform’,” said the statement.

“The facility is a landmark transaction for the Government of Pakistan that demonstrates strong support from leading financiers in the region. This is a five-year multi-tranche facility including both Islamic and conventional tranches,” it said.

The ministry said the Islamic facility was structured to be fully compliant with AAOIFI standards, accounting for 89 per cent of the total financing amount, with the remaining 11 per cent from conventional financing.

AAOIFI standards are a set of guidelines developed by the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) and aim to ensure that Islamic finance practices adhere to Sharia principles and provide a framework for consistent and reliable financial reporting.

“The transaction was also the first facility supported by ADB’s policy-based guarantee linked to policy reform measures undertaken by an ADB member country, i.e Pakistan,” it read.

It further said the ADB programme was designed to support Pakistan in building long-term fiscal resilience and stability and encouraged Pakistan’s re-entry into international commercial markets, with significant interest from Middle Eastern banks.

The ministry said the government successfully entered the Middle Eastern financial market after nearly two and a half years, indicating “the renewed trust of the market in the fiscal stability and the overall improvement in the macroeconomic indicators of Pakistan”.

“This transaction also marks the beginning of a new partnership of the Government of Pakistan with Middle Eastern banks,” it added.

Meanwhile, Khurram Schehzad, adviser to the finance minister, said on X: “Pakistan secures USD 1 billion landmark financing with ADB-backed guarantee and strong Middle Eastern banks’ support.” Earlier this month, the Philippines-based bank approved a USD 800 million programme to strengthen fiscal sustainability and improve public financial management in Pakistan.

Pakistan narrowly avoided default in 2023-24 with the help of the International Monetary Fund, but worked to stabilise its economy with good results during the last year.

In the first 11 months of the current fiscal year ending on June 30, it showed a USD 1.8 billion current account surplus, which has won the confidence of the lenders.

(This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

'Those Who Speak English In Country Will Soon Feel Ashamed': Amit Shah Urges Reclaiming India's Linguistic Heritage At Book Launch

-

'Those Who Speak English In Country Will Soon Feel Ashamed': Amit Shah Urges Reclaiming India's Linguistic Heritage At Book Launch

-

JPSC Project Manager notification 2025 out; apply from June 20

-

JPSC Project Manager notification 2025 out; apply from June 20

-

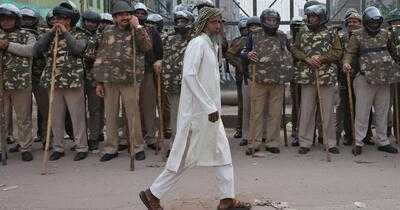

Delhi riots: Judge hearing 'larger conspiracy' case brought back to Karkardooma Court after transfer