New Delhi. In the Income Tax Department Assessment Assessment Year 2025-26, in five cases, the Income Tax Return is going to be strictly investigated. Income tax department will also send notice regarding this. In this, the income, tax, deduction, investment and tax exemption registered in ITR will be investigated.

Actually, this time there have been many major changes in the process of filing income tax returns, such as new forms, amendment in the tax table and important in the rules. Now in many cases the Income Tax Department is going to conduct a thorough investigation. The Central Board of Direct Taxes has clarified this in the new guideline released on 14 June 2025.

-

Also read Priyanka Gandhi is hiding her property, won in Wayanad declared illegal… Court sent notice to Congress MP

The Income Tax Department will examine your ITR closely. During this time your income, deduction, investment, tax exemption, every information will be matched. If any situation stated is applicable, then the notice of investigation will be sent by 30 June 2025. The approval of Principal CIT will be mandatory to exclude a case from the investigation. The Nacfes process on foreign tax matters and central circles will not apply.

There will be investigation on these cases

1. Survey case: If after April 1, 2023, you have a survey of income tax (under Section 133A, except 2A), then your ITR is scheduled.

2. Search or seized case: If between April 2023 to 31 March 2025, you have a seizure of red or documents (Section 132 or 132A), your returns will be examined.

3. Claims of exemption even after the registration is canceled: If the registration of a trust or institution has been canceled (till 31 March 2024) and yet it is claiming tax exemption, then the case will come under investigation.

4. Frequent income cases: If your income was increased by more than 50 lakh (metro city) or 20 lakh (other places) in the first tax fixation and you did not appeal or lost in the appeal, then there would be scrutiny of that case.

5. Case received from investigating agencies: If CBI, ED or any other agency has given information to your tax evasion and you have filed an ITR, then your case will also go to scrutiny.

-

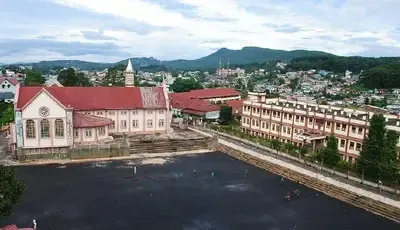

10 Amazing Tourist Spots To Visit in Shillong

-

10 Most Beautiful Places To Explore in South Africa

-

5 tips for boosting energy beyond clean eating and quality sleep

-

Can you spot the hidden frog? This tricky optical illusion has the internet stumped

-

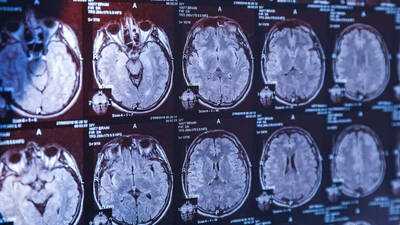

FIFA, WHO join hands to raise awareness on concussions—Symptoms, causes, and how to respond