New Delhi: In a major step towards expanding digital payment access, the National Payments Corporation of India (NPCI) has launched a new service called UPI Circle, based on the Delegated Payment System. The initiative was officially introduced by RBI Governor Shaktikanta Das, aiming to enable more users — even those without bank accounts — to participate in the UPI ecosystem.

🔹 What is UPI Circle?

The UPI Circle allows a primary UPI user to authorize payments on behalf of trusted secondary users, even if those users don’t have a bank account. NPCI explained that nearly 6% of UPI users currently transact for others. With this system, such users can now do it securely and systematically.

🔹 How Does It Work?

-

The primary UPI user creates a "Circle" and adds up to 5 trusted secondary users.

-

These secondary users can initiate UPI payments, but the transaction will only be processed after the primary user approves it by entering their UPI PIN.

-

A secondary user can only be linked to one primary user at a time.

🔹 Spending Limits

-

A monthly limit of ₹15,000 has been set for each secondary user.

-

Each individual transaction is capped at ₹5,000.

This system adds a layer of security while offering convenience for families, elders, or those without access to formal banking. It’s expected to push India’s digital payments landscape even further.

-

Digital inequality in India: 32% women still depend on others’ mobiles

-

6,000 crore lapse: The story of engineer looking for bitcoin will now become a documentary

-

Deepshikha Nagpal says there is no shame in getting married thrice after two failed marriages: ‘I don’t make the same wrong choices again’

-

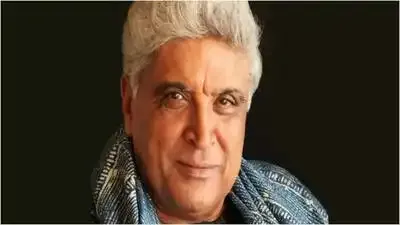

Javed Akhtar receives Dostoevsky Award for influence on cultural heritage, literary dialogue

-

Sanjay Dutt turns emotional: Remembers father Sunil Dutt on birth anniversary: ‘Wish you were there with us’